In the world of prop trading, the best strategies and keenest decisions can make or break the fate of companies and their portfolios. For the uninitiated, the path to successfully navigating trading financial instruments is unclear at best, making this industry one of the riskiest. This is where prop trading firms shine the brightest: by trading with their own capital, prop traders harness a blend of innovation, insight, and adaptability to gain a winning edge in the market.

Prop Trading: Finding a Profitable Balance

Navigating prop trading takes a multifaceted approach. Amidst the highs and lows traders face, the notion of “forex harmony” refers to the nearly mythical balance traders reach when a profit exceeds mere profit margins. Traders that achieve such balance successfully utilize their technical prowess, risk management, emotional resilience, and cutting-edge tech to turn significant profits for their clients. This article considers the elements of Forex harmony and the steps prop firms take to achieve this balance.

The Elements of Forex Harmony

The concept of Forex harmony stems from the core elements of trading. The essential balance needed to achieve a harmonious state comes from a deep understanding of price movements, market trends, and economic indicators. Successful prop traders can integrate fundamental insights with technical analysis, cultivating an insightful understanding of market dynamics.

By combining these elements, traders are better prepared to correctly identify entry and exit points, predict trends, and execute trades precisely. Furthermore, traders can better align their strategies with real-world developments as they stay current on global events and economic news. By pairing their intuition with timely events, traders can develop a well-rounded approach to their practice.

Understanding Harmonic Patterns

In the search for balance in the world of prop trading, harmonic patterns play a unique role. These patterns are intricate formations that mirror cycles commonly seen in financial markets. Derived from market psychology, these harmonic patterns reveal potential reversal or continuation points. The most popular harmonic patterns mimic the Fibonacci sequence, such as the Bat, Butterfly, and Gartley, as these patterns give traders a framework for anticipating price movements.

These harmonic patterns also help traders identify specific price relationships and points, making them better calculate entry and exit strategies. By incorporating such patterns into their trading arsenal, prop trading firms gain an additional layer of analysis that merge psychological and technical aspects. This way, traders can make well-informed trading decisions in a volatile landscape.

Leveraging Technology and Tools

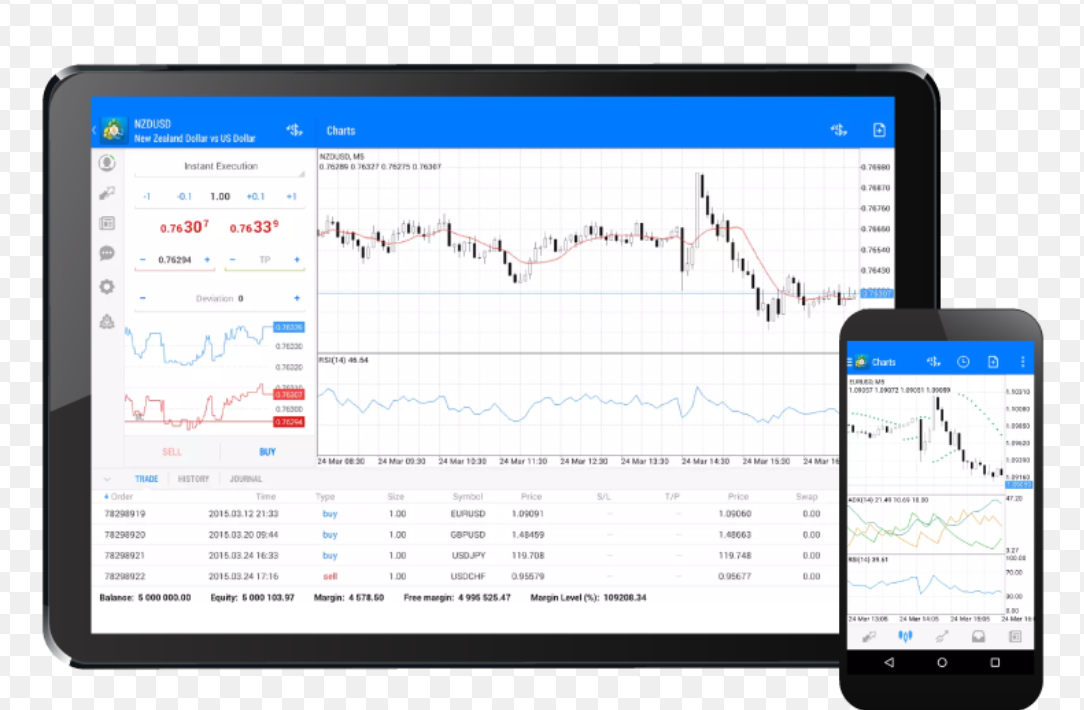

Prop companies equip traders with technologically advanced trading platforms, AI-driven analytics, and algorithmic tools to improve their insights with machine precision. In the search for harmonic trading, these resources empower traders to analyze real-time data, uncover the latest patterns, and execute trades as efficiently as possible. Through technology, prop traders can better harmonize their trading strategies with the speed and accuracy required by the dynamic forex market.

Harmonizing Risk and Reward

Trading in the financial industry is inherently associated with risk, making proper risk management a significant prerequisite for achieving Forex harmony. Forex prop firms must find the right balance between risk and reward by accurately sizing positions, making appropriate stop-loss orders, and intentionally diversifying across different currency pairs, effectively reducing vulnerability to a single trade’s impact. The most harmonious risk management strategies work to safeguard capital while equipping traders with the confidence to make quick decisions.

Navigating Market Volatility

Market volatility is a constant in forex trading, challenging traders to find consistent equilibrium in the face of rapid price swings. The secret to navigating such volatility starts with preparation and adaptability. Traders must learn to adjust their approaches quickly based on factors like volatility levels, geopolitical developments, and economic events. Successful prop traders can harmonize their tried and true strategies with innovative tactics to make reactive and calculated decisions.

When trading within a prop company, traders embrace the idea of Forex harmony by harnessing their unique capabilities for emotional fortitude, risk management, and tech savviness. With an intricate blend of skills and a clear understanding of market trends, traders can strike the right balance in such an unpredictable market.

Author Bio:

Alison Lurie is a farmer of words in the field of creativity. She is an experienced independent content writer with a demonstrated history of working in the writing and editing industry. She is a multi-niche content chef who loves cooking new things.